december child tax credit amount 2021

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to 3600 for children under.

Glasbergen Cartoons By Randy Glasbergen For December 12 2021 Gocomics Com In 2022 Today Cartoon Accounting Humor Funny Friday Memes

The sixth and final advance child tax credit CTC payment of 2021 is being disbursed to more than 36 million families Wednesday the IRS announced.

. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child. Eligible families have received monthly payments of up. The credit amounts will increase for many.

Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of children. From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17. This means that the total advance payment amount will be made in one December payment.

November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in place for. Soon after taking office in 2021 President Joe Biden signed into law the 19 trillion American Rescue Plan Act. For parents with children 6-17 the payment for December will be.

Claim the full Child Tax Credit on the 2021 tax return. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. If you did not receive the stimulus for a.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. However the deadline to apply for the child tax credit payment passed on November 15. For 2021 eligible parents or guardians.

The American Rescue Plan Act expands the child tax credit for tax year 2021. To help taxpayers reconcile and receive all of the Child Tax Credits to which they are entitled the IRS will send Letter 6419 2021 advance CTC starting late December 2021 and continuing into. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. For the 2021 tax year that aid package upped the 2000. Your newborn should be eligible for the Child Tax credit of 3600.

ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

A childs age determines the amount. To be eligible for the. The maximum credit amount has increased to 3000 per qualifying child between.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. The American Rescue Plan significantly increased the.

Eligible families who did not. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Your newborn child is eligible for the the third stimulus of 1400.

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between. June 14 2021.

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

2020 Tax Brackets 2020 Federal Income Tax Brackets Rates Tax Brackets Income Tax Brackets Federal Income Tax

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

![]()

2021 Advanced Payments Of The Child Tax Credit Tas

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

The December Child Tax Credit Payment May Be The Last

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The 2021 Child Tax Credit For Expats Are You Eligible Greenback Expat Tax Services

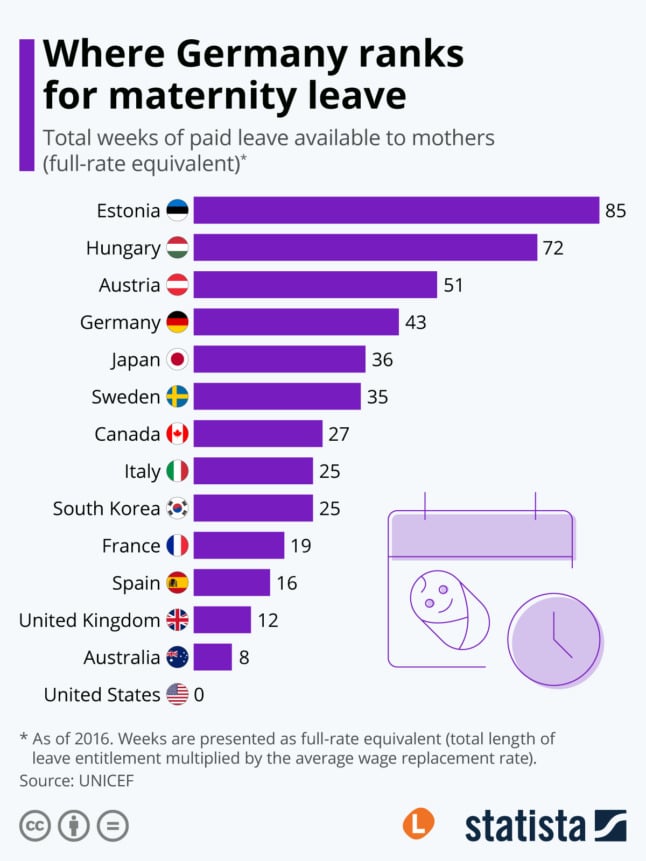

How Germany Plans To Increase Child Benefits And Provide Tax Relief

Glasbergen Cartoons By Randy Glasbergen For June 08 2021 Gocomics Com Identity Theft Today Cartoon Twins

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

What Families Need To Know About The Ctc In 2022 Clasp

Missing A Child Tax Credit Payment Here S How To Track It Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2021 Tax Numbers Tax Return

How Germany Plans To Increase Child Benefits And Provide Tax Relief