tax lien attorney nj

Tax Lawyer Serving New Jersey. Whether you need assistance.

The Tax Law Firm Of Charles A Ray Jr

Compare the best Tax Lien lawyers near Clinton NJ today.

. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. A Certificate of Debt has the same force and effect as a Docketed Judgment adjudicated in any court of law. Since the amount that the bidder must pay for the lien is.

A tax lien cannot be removed by a bankruptcy filing but a debtors liability to pay the tax may. The Attorney Charging Lien. Use our free directory to instantly connect with verified Tax Lien attorneys.

Just remember each state has its own bidding process. A lien is more than just a claim for fees. Find an Attorney.

Just because a seminar or tape makes tax liens sound like a sure thing does not mean it is a smart move for you. Find an Attorney. Certificates of Debt are the primary vehicle for our collection process.

As the tax lawyer New Jersey clients trust to resolve civil and criminal tax disputes he has experience working with a wide range of complicated tax cases. A lien in Burlington County New Jersey is a property right that a person or entity has in property owned by someone else created by law for the. Tax liens are most often placed on homes and it applies to the equity on the property.

Use our free directory to instantly connect with verified Tax Lien attorneys. Trusted New Jersey Tax Lien Defense Attorney Successfully Handles Cases For Clients In Camden County Burlington County Gloucester County And Throughout South Jersey. Nonetheless if the federal government does not seek to enforce a tax lien in Jersey City New Jersey within 10 years of imposing it federal law dictates that the lien automatically expires.

Moorestown NJ Tax Law Lawyer with 42 years of experience. BIDDING DOWN TAX LIENS Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. Check your New Jersey tax.

Search for legal issues. By the same token persuading a Court to vacate a tax foreclosure judgment is no easy task and the property owner must have the ability to pay the tax lien redemption amount. Tax Lien Lawyers in Burlington County.

Search Legal Resources. As a tax and business attorney for more than 25 years I have helped. Compare the best Tax Lien in New Jersey.

Search Legal Resources. It is a secured interest in the recovery that a client achieves through the lawyers efforts of course for the.

New Jersey Real Estate Tax Foreclosure Attorneys

Legals Legal Notice Classifieds Nj Com

Madison New Jersey Divorce Lawyer Charles F Vuotto Jr Esq

Investing In Tax Liens With A Llc Or Corporation Youtube

State Of New Jersey Back Taxes Resolution Options

Real Estate Litigation Attorney Nj English Spanish Curbelo Law

Tax Law New Jersey Tax Appeals Lawyers Mclaughlin Nardi

New Jersey Property Tax Appeal John L Schettino Llc

Dealing With The Obnoxious New Jersey Inheritance Tax Waiver And When It Can Be Avoided

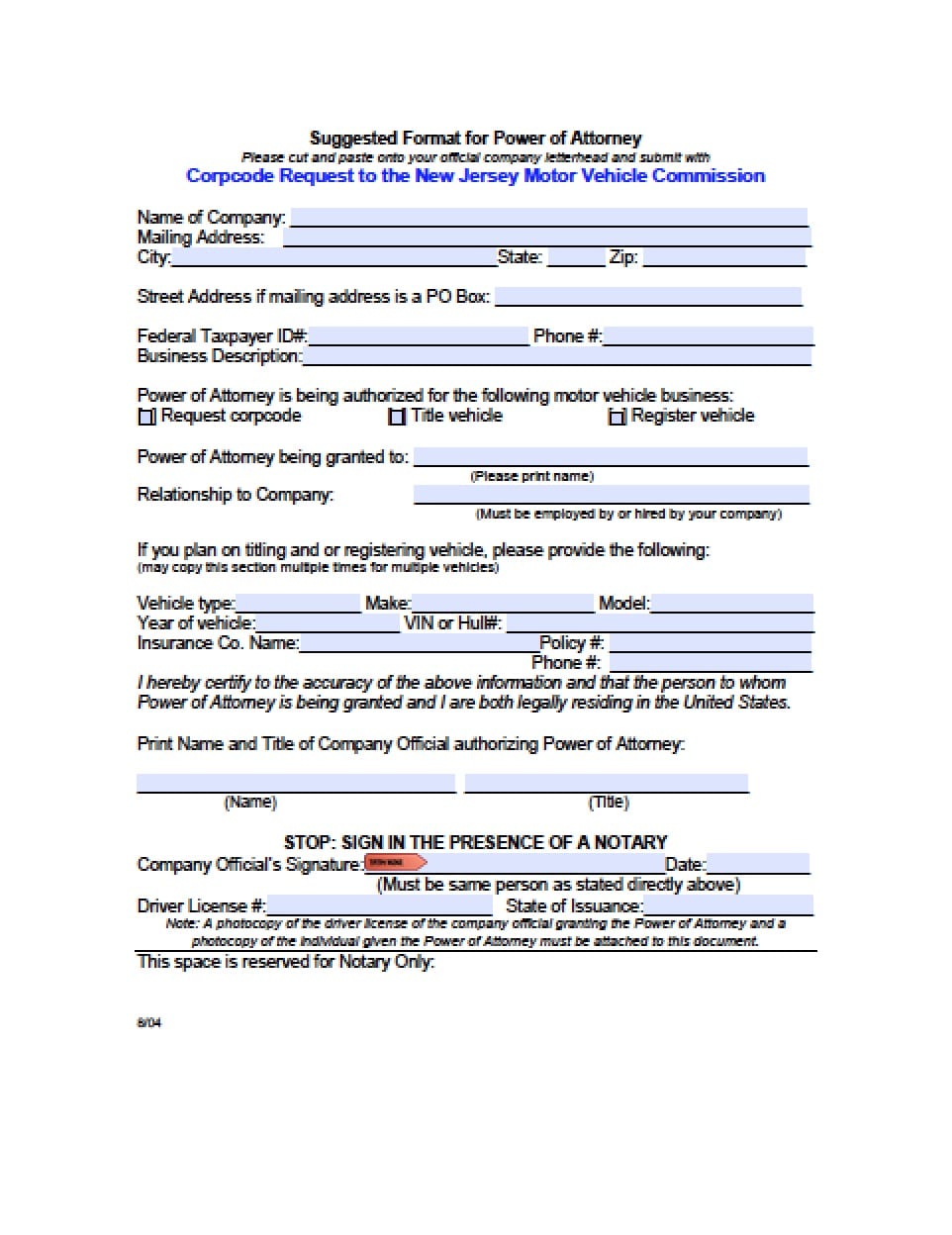

New Jersey Vehicle Power Of Attorney Form Power Of Attorney Power Of Attorney

Voiding A Real Estate Tax Foreclosure Judgment In New Jersey

5 Rules For Discharging Taxes In Bankruptcy In New Jersey

Nj Judge Says Parties With Rights Of First Refusal May Redeem Tax Sale Certificates Walsh

Keeping Your Home After A Nj Tax Foreclosure Sale

Bankruptcy Attorney New Jersey Manchel New Jersey Bankruptcy Law

Is A Real Estate Attorney Required In New Jersey

Nj Tsc Question What Is The Redemption Period Once A Tax Lien Is Sold To A 3rd Party How Long Before Foreclosure Judgment Legal Answers Avvo